Students will be starting back to school soon and Mississippi’s tax-free weekend is coming up to help families get their kids ready for the semester.

The 2018 Sales Tax Holiday takes place between 12:01 a.m. Friday, July 27, 2018, and 12:00 Midnight Saturday, July 28, 2018.

Representative Tom Miles said the Sales Tax Holiday was passed by the state legislature in 2009. He encouraged Mississippians to take advantage of the tax break and shop locally.

“It’s a way to help our local stores generate more money into the economy and also a way to give a little back to our consumers as well,” Miles said. “We’ve looked at legislation in the past and there’s a big push to extend this to our school supplies in the future and we hope to see that pass maybe next session.”

However, the tax-free weekend isn’t going to be just about getting the kids ready for school, adults will see the benefit as well.

“I know there are a lot of people that will want to take advantage of the 7% discount that they are getting by shopping this weekend,” said Kathy Waterbury, Associate Commissioner of the Department of Revenue. “I’m sure that that money is important and when you have a number of children going back to school, then obviously that would all add up. But, the thing is, it’s not just limited to school clothes. Us grown ups who may not have anybody in school can still go out and enjoy it.”

Waterbury added that as long as the item is less than $100 and meets the definition of clothing or footwear then it will be exempt from taxes this weekend. However, accessories are not included in the exemption.

The Department of Revenue defines clothing as being, “any article of apparel designed to be worn on the human body including pants, shirts and blouses, dresses, coats, jackets, belts, hats, undergarments, and multiple piece garments sold as a set.”

Footwear is defined as, “any article of apparel for human feet except for skis, swim fins, roller blades, skates, and any similar items.”

Accessories are defined as “Jewelry, handbags, luggage, umbrellas, wallets, watches, backpacks, briefcases, and similar items do not qualify for the Sales Tax Holiday.”

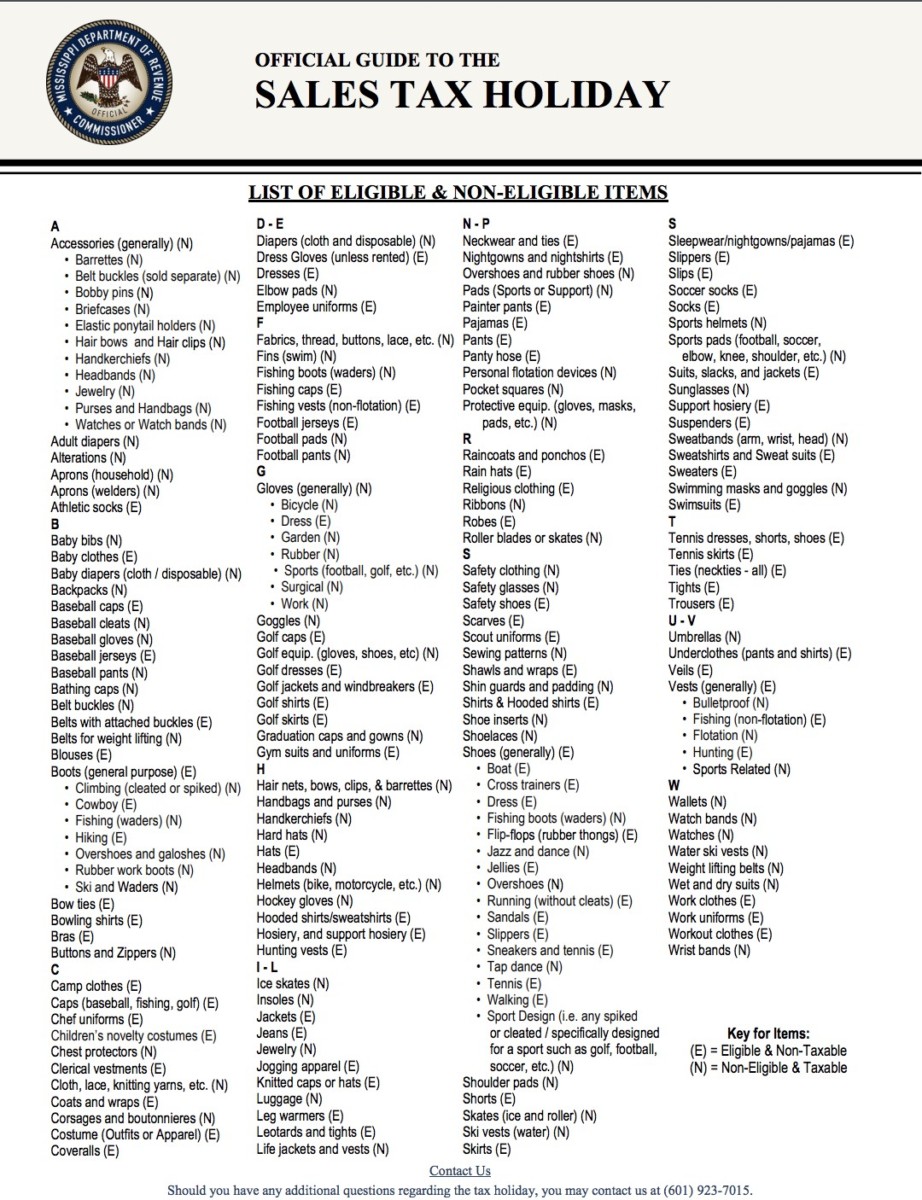

A full list of eligible and non-eligible items: