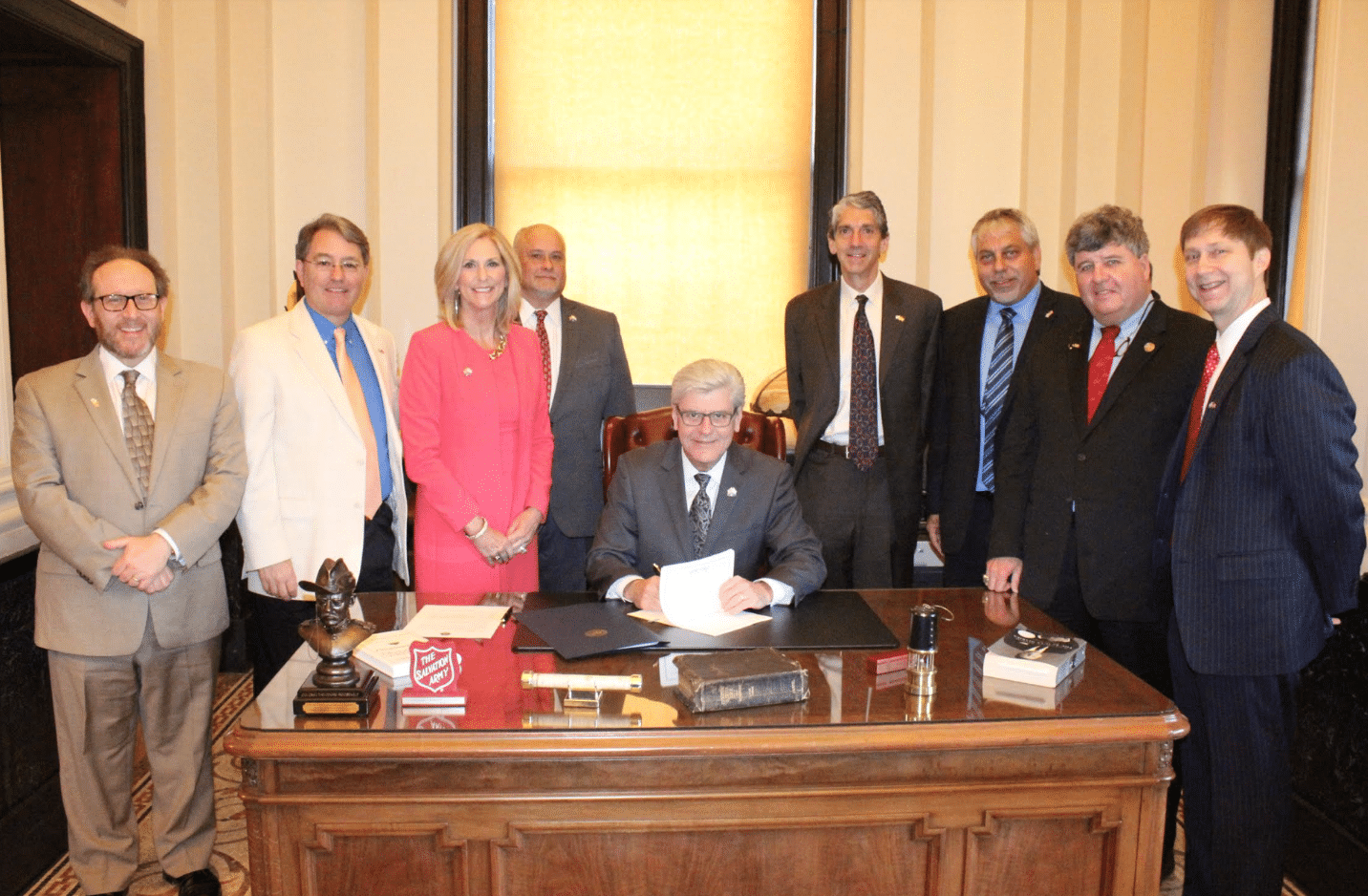

State Treasurer Lynn Fitch announced she is pleased that the Mississippi Legislature has approved a new option for investing State funds, Israel bonds, and that Governor Bryant has signed this bill (SB 2051) into law.

“We are so excited and pleased that the legislature passed this additional option to allow us to generate investments for our Mississippi taxpayers through the Israel bonds,” Fitch said. “Our state investment statute has virtually been untouched the last 25 years and we haven’t really kept up with the markets, so Mississippi has been missing out and this was an opportunity for us, giving us an option with Israeli bonds that’s safe, but also gives us a higher return than our current option.”

She said there are 28 states that have participated in the Israel bonds so far including some of Mississippi’s neighbors, so they have seen that this has been very successful for other states.

“It’s a very safe option and Israel bonds had a higher rate of return than even US treasuries,” said Fitch. “For example, on January 31, 2018, if you’re using the five year coupon, the U.S. Treasuries earn 2.7 percent and the Israel bonds earn 3.65 percent, so that’s a substantial difference.”

She added that in an investment of just $20 million, that’s a difference of $90 thousand, which would be great interest earnings coming to the state of Mississippi.

Fitch also added that is gives them the option to show support to their best ally in the Middle East, so this is a win-win for them all the way around.

“Mississippi is very cautious. We are charged with protecting the public trust of our funds and certainly generating in investment revenue,” said Fitch. “That’s the charge and the mission for this office so this is a very safe opportunity for us and Mississippi certainly doesn’t take risks with the peoples’ money.”

Fitch said that one of the things they talk about is the credit ratings for Mississippi, but Israel bonds also have a very strong credit rating, and have high “A” ratings, which is very important.

“Israel has never missed an interest of principal payment, so that shows the significance and the benefit of being able to invest in these Israel bonds,” said Fitch.

In a newsletter about the Israel bonds, Fitch said, “Each year, my office is charged with investing about $5 billion in State funds. We have three primary goals in these investments: