The day after Hurricane Katrina, I was handing out hot dogs to evacuees in Vicksburg. I stopped what I was doing when Gov. Haley Barbour’s office called and told me to get on a Blackhawk helicopter and head south. Soon, I was airborne with First Lady Marsha Barbour, Sen. Charlie Ross, and a few others, flying over the wreckage of South Mississippi. For 80 haunting minutes, no one spoke. The silence said it all—the devastation was unimaginable.

At the time of that flight, I was the Senate Education Committee Chair. For the next couple of years, my job was helping to rebuild the Gulf Coast school system, which had sustained over $900 million in damage. To get federal funds, we had to implement building codes. In 2006, the state mandated stronger codes for six southern counties. By 2014, those codes expanded statewide, though with an unfortunate loophole: cities and counties could opt out.

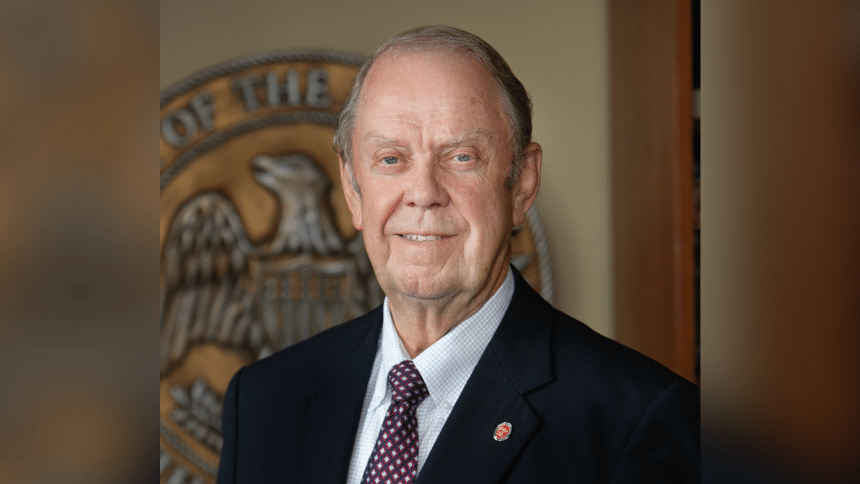

When I became Insurance Commissioner and State Fire Marshal in 2008, my new challenge was bringing insurance companies back to the coast. Our post-Katrina goal was simple but critical: make insurance available, affordable, and accountable. Accountable, meaning that companies would pay valid claims. A denied or unpaid claim can be as devastating as the storm itself. Financial failure is its own form of a catastrophic event.

We also learned we had to build stronger homes. Remember the Sunday school story? The wise man built his house on rock. That principle guided our approach. The building codes implemented in 2006 were a good start. Then, in 2012, the Federal Emergency Management Agency (FEMA) changed the elevation requirements on the coast for new or improved structures and manufactured housing, raising the Base Flood Elevation (BFE) by three feet.

Two decades after Katrina, we’re still fighting for stronger building codes. As a comparison, Alabama saw the value in better codes and launched a mitigation program in 2016. Since then, they’ve mitigated 50,000 homes in Mobile and Baldwin Counties and fortified 8,000 through the Strengthen Alabama Homes program. Those homeowners now enjoy insurance discounts of 20–30%.

There was hope for Mississippi when, in 2024, the Mississippi legislature funded the Comprehensive Hurricane Damage Mitigation Program with $5 million, taken from insurance companies, not taxpayers. The program, also known as Strengthen Mississippi Homes (SMH), offered homeowners in the lower three counties $10,000 to retrofit their roofs and see lower premiums. We asked to expand funding for the program in 2025, and the effort died. Then came the real blow: during the May 2025 Special Session, the legislature defunded the program entirely, even though we had completed a test phase, mitigated 28 homes, and were ready for a full launch in July.

So now, we must act individually. I hope that, even without an active mitigation program, people will take the matter into their own hands. I urge you to prepare now. Talk to your insurance agent, make sure you have proper coverage, and read your policy. Pack a Go-Bag, make an evacuation plan, and mitigate your home as best you can now.

If a hurricane hit tomorrow, I believe we’d be better prepared than we were in 2005. Why? Because we’ve built higher, enforced smarter regulations, and used stronger materials. Those changes have directly lowered insurance rates. It’s simple: build better, pay less.

Still, we can’t rest. Let’s pray that the next twenty years are filled with quiet storm seasons. But let’s not rely on hope or prayer alone. Call your legislators. Demand funding for mitigation programs. As storms grow more frequent and fierce, we cannot afford to be complacent. Preparation saves lives and property. And now, more than ever, it’s in our hands.

The views expressed by contributors are their own and not the views of SuperTalk Mississippi Media.