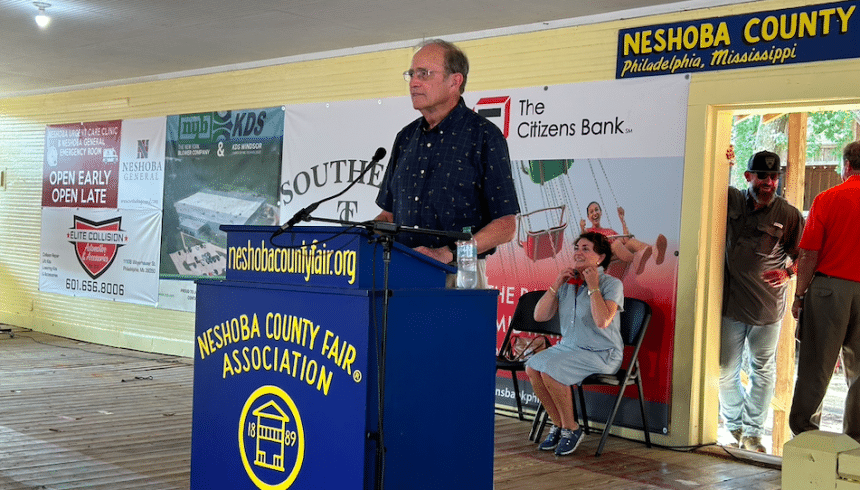

Though Mississippi Lt. Gov. Delbert Hosemann decided not to use the Neshoba County Fair to announce a 2027 bid for governor, the Republican made two things abundantly clear during his stump speech: He is dedicated to returning money to taxpayers, and he is committed to getting public school teachers another pay raise.

Hosemann, who addressed a myriad of other topics including government reorganization, curbing veteran suicide rates, expanding the state’s workforce, funding the public employees’ retirement system, and revitalizing the capital city of Jackson, was especially keen on growing the economy through tax rebates and investing in K-12 classrooms.

Earlier this year, state lawmakers enacted legislation that will gradually phase out Mississippi’s income tax. While the new law featured immediate relief by means of a 2% reduction in the tax on groceries, it also included a 3-cent increase on each gallon of gas purchased in the state. Additionally, the income tax phase-out process will not begin until 2027. So, in the meantime, Hosemann is vying for a major tax rebate to put money back into the pockets of those who subsidize the government.

While on the main stage at Founder’s Square, Hosemann vouched for a $316 million tax rebate to be passed by the legislature in the upcoming session. The Senate leader’s proposal would result in taxpayers being handed back 15% of what they paid the state in 2023. For example, one who paid $1,000 in state taxes would be eligible to acquire a $150 check. This is not Hosemann’s first rodeo with tax rebates. Ahead of the 2023 session, he urged the legislature to return $270 million to taxpayers.

Hosemann, noting that President Donald Trump has floated the prospect of sending rebate checks to Americans from the money generated by his tariffs, joked that Mississippi has been ahead of the curve when it comes to sending funds back to their rightful owners. He further asserted that the Magnolia State is in an excellent financial position, with over $1.4 billion in cash on hand, and that a stewardly form of money management would be to give back to the ones paying taxes.

“We’re going to have what I believe is the largest tax rebate in Mississippi history. $316 million will be paid back to taxpayers if the Senate’s position is to accept [the proposal], ” Hosemann said. “We have additional funds that have arrived. They came from the taxpayers, and we’re going to give them their money back.”

It’s no secret that Mississippi has experienced major wins in education in recent years. With significant improvements in fourth and eighth-grade math and reading scores, record-breaking high school graduation rates, a downtick in dropouts, and school districts bettering their accountability grades, momentum is on the state’s side.

To build on these achievements, Hosemann is looking to pass another teacher pay raise. Mississippi made history in 2022 when Gov. Tate Reeves signed the state’s largest-ever pay increase for educators into law, though studies show that teachers in the Magnolia State still earn the lowest average salary in the U.S.

Aiming to fill nearly 3,000 vacant K-12 teacher positions and enticing educators not to pursue a career in what would otherwise be a more lucrative field, Hosemann is pushing for salary bumps to have Mississippi’s future generations instructed by quality teachers. The prospective pay bump, per Hosemann, should also apply to community college employees, especially those in career and technical fields.

“We need another teacher pay raise. We’re going to get that teacher pay raise,” Hosemann exclaimed. “Our community colleges are struggling to keep these people teaching various technical courses. They can’t keep teaching because there is too much money outside [the classroom] … We need to keep the people teaching our kids compensated so that they can keep teaching our kids.”

Hosemann also urged lawmakers to pass a bill that would incentivize retired educators to return to the classroom. After discussing teacher pay and ways to fill classroom vacancies, the lieutenant governor pivoted to the state’s chronic absenteeism rates. Chronic absenteeism is defined as missing 10%, or 18 days, of the school year for any reason, which includes excused and unexcused absences and suspensions.

During the 2023-24 school year, the state’s chronic absenteeism rate was 24.4%, a slight increase compared to 23.9% in the prior academic year. Chronically absent students have an increased chance of dropping out of school and a higher likelihood of being incarcerated compared to pupils who are consistently in the classroom. Hosemann said the Senate will strive for stricter truancy laws this year.

Looking to keep parents accountable if their child is missing large chunks of classroom hours, Hosemann deems it necessary to have school attendance officers knocking on doors statewide in search of answers as to why a chronically absent pupil could not be in his or her respective education center. Taking things a step further, Hosemann is also in favor of parents having to testify before a judge as to the reason for their child’s noticeable absence from class.

“Those kids have no chance for an economic future. We have to get our children back in school,” Hosemann concluded.