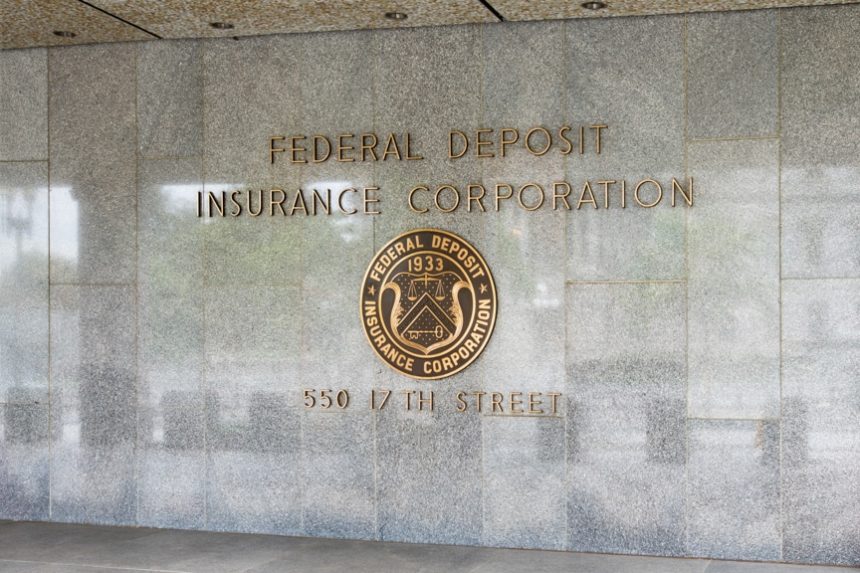

Operations at Silicon Valley Bank in Santa Clara, California have officially started again under the management of the Federal Deposit Insurance Corporation (FDIC) after being force to close over the weekend.

Now, the former bank has been temporarily titled the Deposit Insurance National Bank of Santa Clara (DINB), making Silicon Valley Bank the first FDIC-insured institution to fail this year.

The FDIC released the bank’s closure on Sunday, stating that the company’s total number of assets and deposits were not known at the time.

“As of December 31, 2022, Silicon Valley Bank had approximately $209.0 billion in total assets and about $175.4 billion in total deposits. At the time of closing, the amount of deposits in excess of the insurance limits was undetermined,” the FDIC said in a press release. “The amount of uninsured deposits will be determined once the FDIC obtains additional information from the bank and customers.”

Dave Dennis, the president of Specialty Contractors & Associates, said that the California-based bank was not the only institution to collapse within the week, as New York’s Signature Bank also closed on Friday.

“Two things went down over the past week: Silicon Valley and also Signature Bank,” Dennis explained. “Both of them were heavily invested in tech, which is very speculative. A lot of start-ups, a lot of tech. There was a lot of intra-capital money that was loaned out through Silicon Valley Bank in California.”

Dennis stated that although Signature and Silicon Valley’s failures were both attributed to a large number of investments in cryptocurrency, Signature was also struggling due to interest rates and the tight economy, causing the company to drain cash reserves at a quick rate.

“Signature had done investments in a long way, meaning they had long-term investments, at a certain return that as interest rates came up, they’re paying out more than that return,” Dennis said.

Dennis added that the collapse at both banking institutions should not affect banks across Mississippi and the surrounding states due to various types of investments made at community banks.

“Primarily, the banks in the south and most banks around the country that are community banks and — as you say it — most of your medium-sized banks, they’re heavily invested in real estate, not speculative real estate,” Dennis said. “They’re invested in businesses, they’re invested in personal loans and other things. They’re not into crypto, they’re not into certain areas that are typically very high return and very high reward, but typically have a high risk.”

Dr. Ken Cyree, who is the Dean of the School of Business Administration, the Frank R. Day/Mississippi Bankers Association chair of banking, and professor of finance at the University of Mississippi School of Business Administration, explained that he thinks Silicon Valley took on too many high-risk investments leading up to its failure.

“There’s a lot of stupid going on here,” Cyree said. “I would actually expect most of my undergraduate students would not do what Silicon Valley Bank did. They really made some critical errors that were pretty basic to banking.”

Cyree said that at this time, he believes the best solution would be for major depositors to absorb the loss as the FDIC standard only covers up to $250,000 per insured bank.

“The best thing they can do… is to let the people that have money in that bank over $250,000 absorb the loss. The shareholders are already wiped out, make sure the large depositors get a hit too,” Cyree stated. “If you don’t, then all of a sudden the incentive is to not worry about it and just put your money in because the government or FDIC fund or whatever will bail you out.”