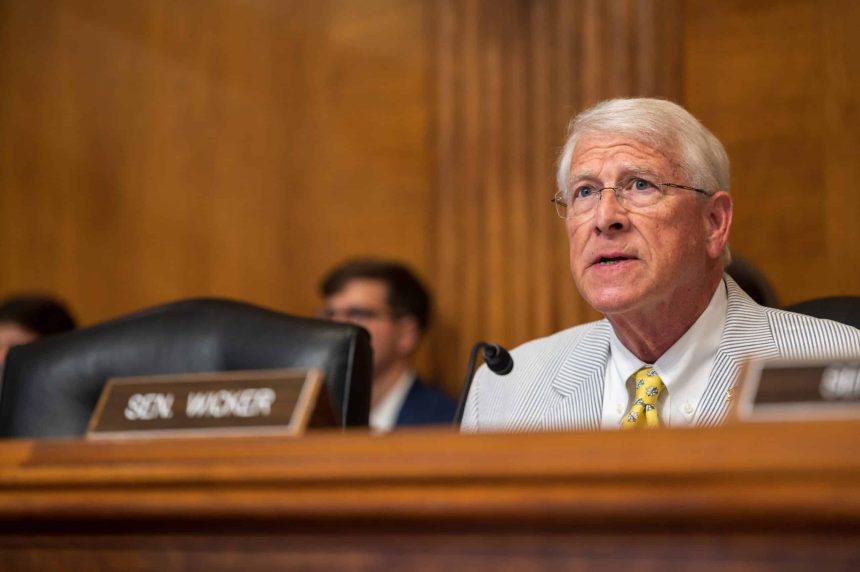

U.S. Sen Roger Wicker (R-Miss.) and Democratic counterpart Sen. Michael Bennet (D-Colo.) partnered to introduce a bill called the Lifting Our Communities through Advance Liquidity for Infrastructure Act of 2025.

The LOCAL Act would amend the current federal tax code to restore state and local governments’ ability to use advance refunding to manage bond debt, reducing borrowing costs for public infrastructure projects. Wicker says the measure would directly contribute to lowering the barrier to infrastructure improvements by state and local governments across the country.

“Restoring advance refunding would help community leaders manage their existing debts and allow for more investment to improve their existing infrastructure,” Wicker said. “Local leaders know what their states need best, and it’s important to give them the resources to ensure their community’s success.”

Advance refunding is a financial tool that allows state and local governments to refinance outstanding municipal bond debt to more favorable borrowing rates or conditions before the end of the bond terms on a tax-exempt basis. The process is similar to homeowners refinancing their mortgages to secure a lower interest rate.

“As state and local governments work to improve their communities and plan for the future, our bipartisan bills will support their efforts to revitalize infrastructure, create jobs, and improve quality of life for all Coloradans,” Bennet said. “From improving our roads and bridges to modernizing our hospitals and schools, this legislation will help create stronger and more resilient communities.”

Advance refunding previously saved state and local governments billions of dollars over decades, but has been unavailable since 2017. According to the National Association of State Treasurers, the inability to utilize advance refunding has resulted in governments paying more in interest, resulting in higher costs that are paid by state and local residents.

For a one-page outline of the legislation, click here. View the full legislation here.